Inverse Head and Shoulders Definition Forexpedia™ by

Downtrend. First shoulder. Neckline. Head. Second shoulder. The inverse head and shoulders pattern begins with a downtrend. This is the extended move down that eventually leads to exhaustion and a reversal higher as sellers exit and buyers step up. That downtrend is met by minor support, which forms the first shoulder.

Inverse Head and Shoulders Pattern Trading Strategy Guide

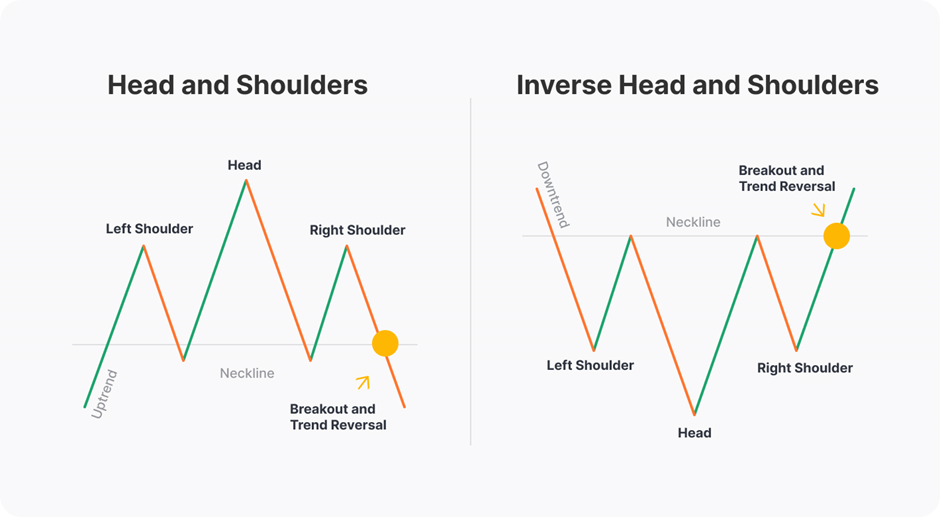

An inverse head and shoulders pattern can appear in all markets, all the time. It is linked with the reversal of a downward trend. The Inverse Head and Shoulders (iH&S) bottom pattern is composed of three peaks. The two outside peaks are about the same height, and the middle one is the lowest. It is a reversal pattern, from bearish to bullish.

How to Trade with the Inverse Head and Shoulders Pattern Market Pulse

An inverse head and shoulders pattern can only indicate trend reversals from downward to upward and provide valuable insights into trends. What are some common mistakes Traders do when trading an Inverse Head and Shoulders Pattern? Trading in the financial market is a challenging process and traders can make mistakes. There are 3 common.

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

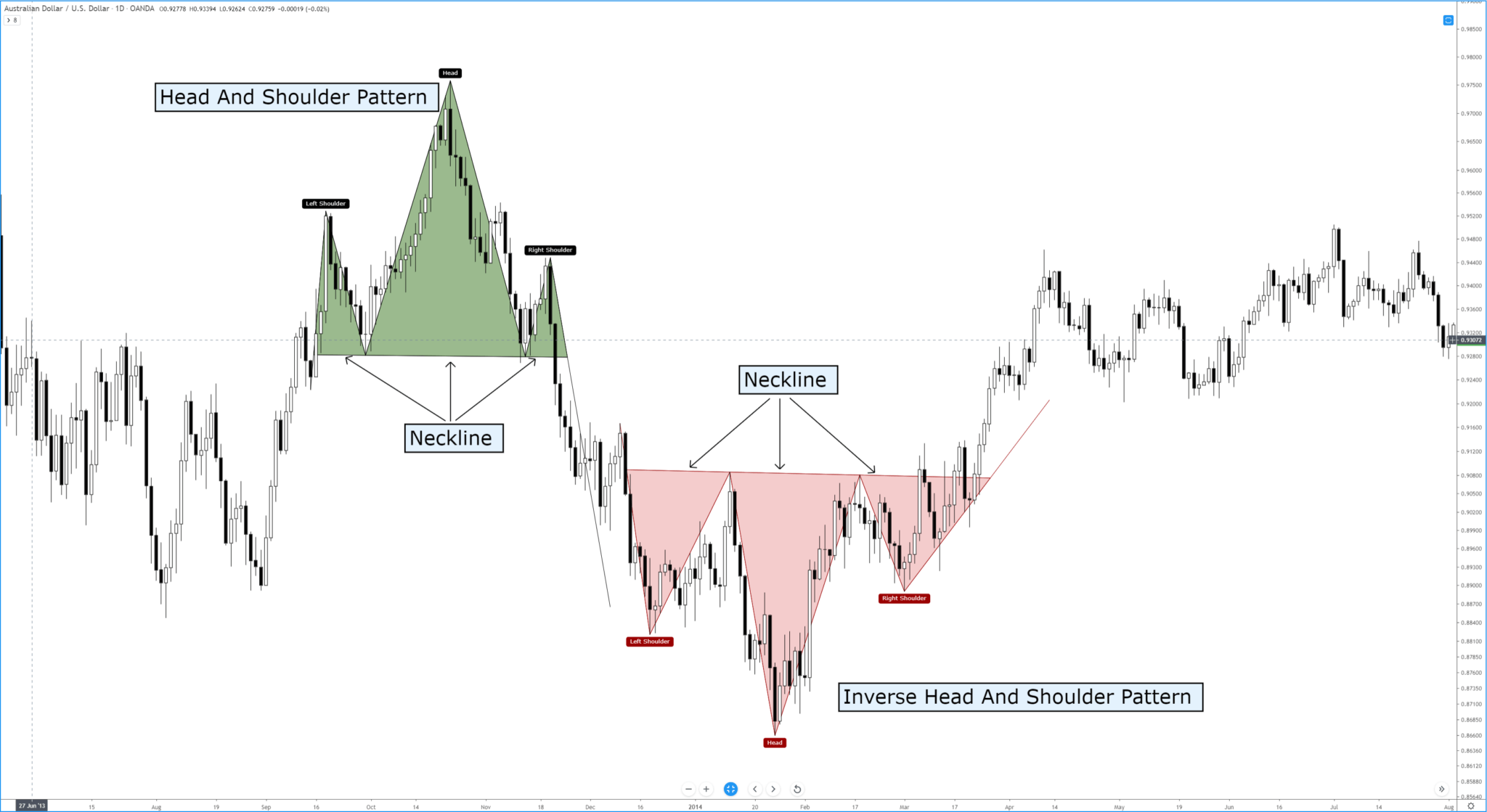

Pay attention to the size of the Inver Head and Shoulders relative to the downtrend. If it's small, then the chart pattern is likely to fail. The best scenarios to trade the Inverse Head and Shoulders: 1) in an uptrend 2) when it leans against higher timeframe structure 3) it takes more than 100 bars to form.

What is Inverse Head and Shoulders Pattern & How To Trade It

An inverse head and shoulders pattern is a technical analysis chart pattern that signals a potential trend reversal from a downtrend to an uptrend. Both "Inverse" and "reverse" head and shoulders patterns are the same. "Head and Shoulder Bottom" is also the same thing. In simpler words, an inverse head and shoulders pattern is like.

Head and Shoulders Pattern What Is It & How to Trade With It? Bybit Learn

An Inverse Head-and-Shoulders chart pattern (aka Head and Shoulders Bottom, Reverse Head and Shoulders) usually helps you to catch big upside movements. Head and Shoulders Bottoms go to the upside as a successful breakout about 75% of the time. In fact, it has the probability to give you impressive gains when you trade this pattern perfectly.

Head And Shoulder Pattern In Trading UnBrick.ID

An inverse Head and Shoulders (H&Si) pattern is a trend reversal chart pattern. This chart pattern is the opposite of the traditional "Head and Shoulder (H&S)" pattern. The principle of the pattern is identical to that of a triple Bottom, with the exception that the second trough is lower than the other two.

Inverse Head And Shoulders Pattern [2023 Update] Daily Price Action

In the realm of technical analysis, dominating chart patterns is vital for traders and investors expecting to effectively explore financial markets.One such pattern that holds significant weight is the inverse head and shoulders pattern. This guide means to give an in-depth exploration of this pattern, covering its definition, components, identification methods, strategic implications, and.

Head and Shoulders Trading Patterns ThinkMarkets EN

The inverse head-and-shoulders pattern is a common downward trend reversal indicator. You can enter a long position when the price moves above the neck, and set a stop-loss at the low point of the right shoulder. The height of the pattern plus the breakout price should be your target price using this indicator.

Chart Patterns The Head And Shoulders Pattern Forex Academy

In essence, the inverse head and shoulders pattern is a bottoming chart pattern - meaning, sellers fail in pushing prices lower below a certain support level. As a result, in the vast majority of cases, the asset's price is expected to rise after the inverse head and shoulders pattern has occurred and the pattern is, indeed, among the most.

How To Trade Blog What is Inverse Head and Shoulders Pattern? Characteristics And How To Trade

An inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the head, and two higher low peaks that make up the left and right shoulders. The right shoulder on these patterns typically is higher than the left, but many times it's equal. Sometimes, there is a fake out, which makes the right.

How to Trade Inverse Head and Shoulders Pattern A Complete Strategy Trade Revenue Pro

The inverse head and shoulders pattern typically indicates that a stock, cryptocurrency, future, or other asset is about to reverse a downtrend. There is a possibility that an inverse head and shoulders can form during a pause in an uptrend, but these are typically called cups, or cupst with handles. The reason the inverse head and shoulders.

What is Inverse Head and Shoulders Pattern & How To Trade It

The Head and Shoulders Bottom, sometimes referred to as an Inverse Head and Shoulders, is a reversal pattern that shares many common characteristics with the Head and Shoulders Top, but relies more heavily on volume patterns for confirmation. As a major reversal pattern, the Head and Shoulders Bottom forms after a downtrend, with its completion.

How To Trade Blog What is Inverse Head and Shoulders Pattern? Characteristics And How To Trade

Its opposite is an inverse head and shoulders pattern that is the same but reverse and hints at an upward price trend - a bearish-to-bullish trend reversal. Formation of the head and shoulders chart pattern. The head and shoulders pattern appears on a chart as three peaks, with the middle peak being slightly higher than the two sides, forming.

Inverse Head and Shoulders Chart Pattern Trading charts, Chart, Stock chart patterns

The inverse head and shoulders pattern heralds a bullish reversal and consists of three troughs, with the central one being the deepest. It generally occurs at the end of a downtrend, signaling a potential upswing. In contrast, the regular head and shoulders pattern indicates a bearish reversal. It features three peaks, with the central peak.

Inverse Head and Shoulders Pattern How To Spot It

Inverse head and shoulders is a price pattern in technical analysis that signals a potential reversal from a downtrend to an uptrend. The pattern resembles the shape of a person's head and two shoulders in an inverted position, with three consistent lows and peaks. The pattern is significant because it suggests that the selling pressure.

.